Market Risk Reporting

Market Risk Reporting Doesn’t Need to Be Difficult or Expensive

.gif)

Simplicity Meets Power

Choose your approach to risk management reporting. Get reports on-demand through our interactive portal, as part of an automated process, or both.

The power of Theorem is our agnostic approach to data collection.

Daily, Monthly, or On-Demand VaR or Stress Reports with no work required on your side. We will connect to your clearing brokers or other providers to get your trades and positions reliably and accurately.

You can also send us your own trade or position files from your own systems as part of a straight-through or “what-if” process. You send us your portfolios; we send you back results.

Use our portal to view VaR and Stress in reports and download the information as executive styled PDF reports or rows and columns. Everything that you get on our portal can be easily automated as a straight through process.

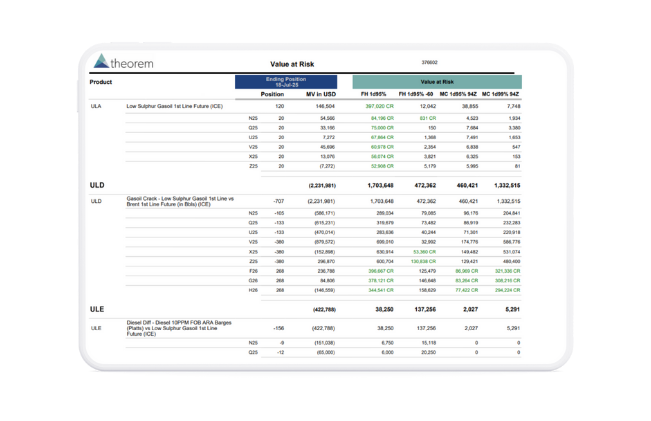

View different VaR scenarios on the same report and see how each position in your portfolios contributes to the respective VaR. Use multiple lookback periods, compare Monte Carlo versus Historical, or change the confidence levels or time horizons at any time.

Value at Risk (VaR)

- Parametric, Historical, Monte Carlo and Others

- Individual, Portfolio, Component, or Custom Partitioning

- Confidence Levels

- Time Horizons

- Lookback Periods of 30 Days-5 Years

- Many Other Features

Stress Testing

Apply hypothetical shocks to understand portfolio behavior under extreme market conditions

- Spot, Volatility, and Scenario Analysis

- Single and Multiple Dimensional Shocks

- View your Actual Market Values Along Side Shocked Market Values

P&L and Exposure Analysis

Add VaR and Stress measurements to our existing array of P&L, open position, and exposure reporting.

- Market Value, Exposure, Realized and Unrealized Gains and Losses

- Single Day, Month to Date, Year to Date, Inception, or any Custom Date Range

- Breakdown of P&L by realized amounts, option premiums, trading costs, and other dimensions

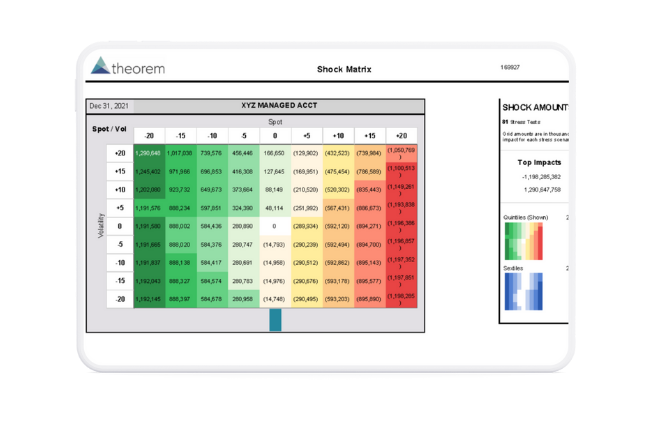

Multiple Shocks on One Report

See up to 144 stress tests on one report in our Shock Matrix that shows the impact with different volatility and spot shocks.

Component VaR and Multiple VaRs on One Report.

See what specific products and positions in your curve are driving and reducing your risk based on scenarios

Utilizing the Power of

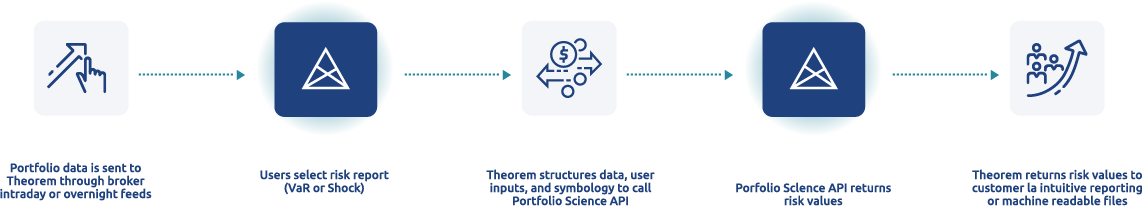

Theorem uses Portfolio Science to securely and quickly produce market risk analytics. There is no onboarding or transition time required because we are always plugged in and only transmit anonymous data.

Built for Every Role and Company

Our risk management tools provide valuable insights across your entire organization, from front office to operations.

Concise and clear dashboard style reporting sent to you daily or only when thresholds are met, with the ability to dig deeper always ready if needed.

Change the way the risk reports attribute VaR or zero in on specific accounts, date ranges, or products based on the specific conditions at the time.

Use VaR calculations as an independent and cost effective comparison to broker reporting and use the data to help optimize collateral management.

Theorem can connect to new brokers, new data files, and adapt to your changing needs with very little time and cost so you can focus on more important initiatives.

Ready to Optimize Your Risk Management?

Interested in learning more about Theorem's risk capabilities or want to see your portfolio's risk attributes in action?