As we kick off the new year, we would like to share with you some of our thoughts regarding what we expect to see and prioritize in the new year. 2022 will be a year defined by its innovation, devotion to service, development of tools to mitigate risk and manage responsibility, advancements in AI, ability to secure cyber threats, industry standardization, movement to the Cloud, and increased regulation of Digital Assets. Below is an expansion of our thoughts on these topics assembling our collective perspective on 2022.

Post Trade Innovation: Less Disruptive, More Sustaining

We rightly describe asset digitization, cryptocurrency, and distributed ledger technology (DLT) as disruptive. New marketplaces have been created that have given access to new segments of crypto investors. But for post trade derivatives, look for these concepts to take hold more as sustaining innovation rather than disruptive.

Commodity derivatives and the NFT market are great examples. At first, these might seem like different topics, but the fact is that we can now tokenize commodities as a direct result of the evolution of blockchain-like technologies. In these cases, we aren’t upending the marketplace or changing the way everything is done, but rather increasing efficiency and reducing risk in an asset class that has been notoriously lagging other asset classes in technological innovation. Fixed Income and equities can see some of the same benefits of course, but in 2022 I’m looking forward to commodity markets playing some much-needed catchup with post trade innovation.

Thinking More about the Second “S” in SaaS

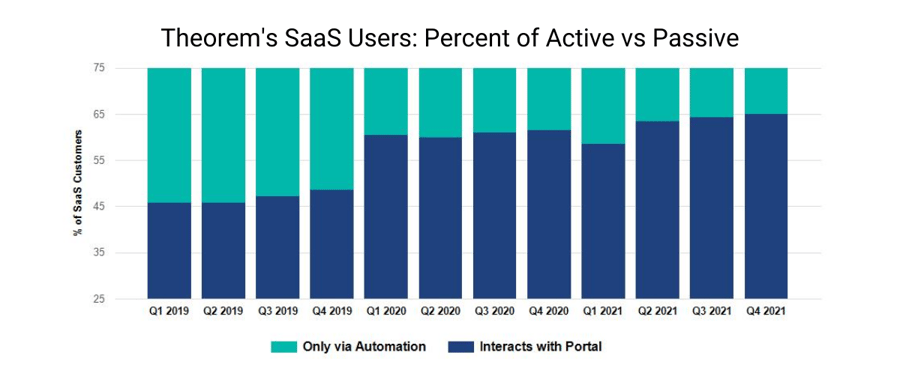

Adoption and acceptance of Software as a Service continue to increase with the requirements of remote work. Meanwhile, advances in cloud computing cyber-security have caught up (and in many cases exceeded) with legacy systems. Even among our existing SaaS clients, we’ve seen big increases in active interaction on our site in 2021 versus passive “fire and forget” use of SaaS to set up innovation on a one and done basis in previous years.

But even the best software can’t solve all the problems in complex post trade workflows and even the best data management solutions still need human ingenuity to address unique situations. That’s why we are looking forward to increasing our client engagements in 2022. Using SaaS doesn’t have to mean losing access to domain experts. We’ve expanded our team to make more experts available to all our clients and have also launched an Operations as a Service (OaaS) model for clients who want to outsource post trade operations or functions.

Increased Demand for Integrated Risk Mitigation Tools

Here at Theorem, it is my job to listen to our clients to not only understand their needs but to know how to meet them. Based on my interactions in 2021, I expect to see greater demand for integrated risk tools as we move into 2022. As a data hub, we are advantageously positioned to create informative market risk reports for our clients through a Software-As-A-Service offering. By making VaR, Stress, and other transparency tools more accessible via SaaS, we can empower our clients to tailor the tools to match their unique definition of risk in 2022.

Be on the lookout for future announcements. We have several enhancements coming this year that include really useful dedicated market risk reports and features but also have gone back to “enrich” many of the existing post trade report artifacts with risk statitics for those who want everything in one place.

Firms must provide the right tools to effectively manage their responsibility

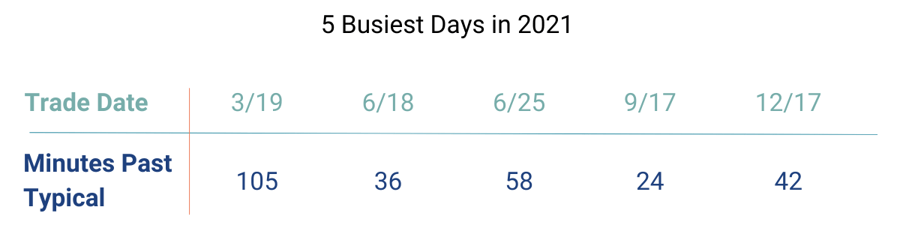

Year over year, we continue to see volume and transaction frequency increase – 2021 was no exception. Although the technology infrastructure utilized by exchanges and FCM’s has sufficiently handled those increases, the tech was never developed with these trading levels in mind.

This stress on the system is burdening staff and clients beyond acceptable and safe limits. On busy market days, we routinely see significant delays from our partner providers in providing overnight data and completing intra-day workflow tasks.

Giving staff the right tools to effectively manage their responsibility needs to be a focus for both buy and sell-side firms in 2022. Fortunately, a complete technology overhaul is not necessary. Rather, firms need to adopt and implement supplementary software that allows participants to proactively address exceptions thereby preventing downstream bottlenecks and delays.

Ultimately these adoptions will promote the right framework of operational efficiency and risk mitigation, allowing our markets to welcome new entrants and continue to grow.

Artificial Intelligence will continue to make us more efficient

Each year, the support we can provide to our clients only gets better and more encompassing. Whether it be in matching, allocation, or reporting, the goal remains the same – and that is to forever improve ease and efficiency for our clients. Over the years, our ever-increasing use of artificial intelligence has allowed us to make substantial advancements in the processes and reporting that can be automated.

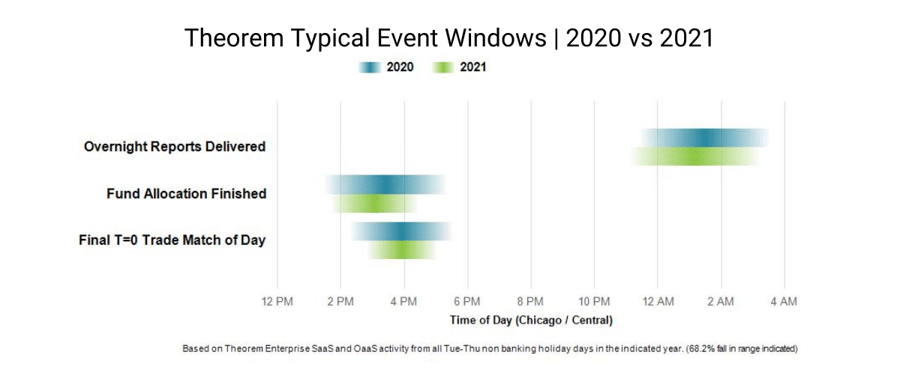

Compared to the same time last year, the middle office tasks we support are occurring earlier and in a more predictable time window thanks to these improvements. I believe as advancements in technology bolster our solution, the level of support and service we offer our clients will only strengthen.

Cybersecurity, Cybersecurity, and more Cybersecurity

Cybersecurity is always a top priority here at Theorem Technologies and remains to be in 2022. We leverage and have many Predictive Intelligence processes in place to identify cybersecurity risks to the platform. And it all begins with collecting user logins, behaviors, actions, and geolocation data. With such a large sample size, we can learn and predict client usage patterns – when they log in, where they log in, what action was performed, etc. Our data set allows us to develop a set of rules to understand when something happens outside of the ‘normal’ usage pattern. For example, if a client logs on from a different country, we can identify this and investigate further if necessary.

Email phishing is another cybersecurity threat that no business can take lightly in 2022. Prevention requires both technology solutions and employee education. Technology solutions, at the very least, must include securing email gateways to prevent phishing emails from reaching employee email inboxes and implementing Junk and Spam mail rules. But above all, no prevention is stronger than employee education. Providing education and training around common phishing techniques, spoofing and suspicious messages will certainly assist in mitigating cybersecurity risks in 2022.

Your Back-Office is Your Brand

For many of our clients, their firm’s brand isn’t necessarily the number one issue on their minds for 2022. But, as the Director of Marketing for Theorem Technologies, in my humble opinion, it should be. The way you handle data management, mitigate security breaches and offer risk reports are all major components that can either positively or negatively affect your brand depending on the solutions you have in place to control these areas. Whether you know it not, the actions and processes you implement in your back-office will majorly impact the way your firm is perceived by your clients. In 2022, your brand is all about performance, reputation, and client experience. You can’t afford to have crucial components of your back-office negatively affect your brand especially in times where performance just isn’t there.

Reevaluating Processes. Standardization. Cloud. Digital Assets

As Director of Sales at Theorem, I get the unique opportunity to talk to and learn from people across the industry – clients and prospects on both the sell and buy sides, partners, and vendors. I see a few things that our clients and the industry at large will focus on in 2022.

- Re-evaluating what processes produce results. I see more and more that firms have implemented unique operational processes that may be well-intentioned but are not delivering the results or risk mitigation they intended. This year, I think more firms are going to re-evaluate what processes they need to maintain and enhance, and what tools they need to successfully execute those processes.

- Standardization. With that re-evaluation, we are going to see steps to standardization across the industry. Unfortunately, I’m not talking about symbology (one could only hope), but rather, process standardization, formats, SLAs.

- Cloud. With CME and Nasdaq announcements, we’re going to see less and less push back on the Cloud. There will certainly continue to be stringent security requirements (as there should be), but firms are going to take note from some of the world’s pre-eminent exchanges starting the transition

- Digital Assets. Aside from the investment merits of the asset class, its forthcoming entrance to regulated US derivatives is going to force us to evaluate the market structure, data costs, and intermediary participation.

Speaking on behalf of all of us here, we’re looking forward to seeing what 2022 will bring, and how Theorem can help you simplify your post-trade processes. Don’t hesitate to get in touch.