The financial services environment is both diverse and complex, particularly when it comes to the myriad ways in which firms use data and the many forms in which data comes. Data is the foundational element of analysis, and the ways in which it can be used seem boundless. Because data fuels a universe of diverse processes, many firms use proprietary systems or highly customized software to meet their individual needs. Moreover, there aren’t strong incentives for firms to share data when transactions can be relatively anonymous and the emphasis on security and privacy is high. Consequently, data is not standardized across the industry and firms spend considerable time and money getting data into a workable, standardized format for analysis. Firms that include futures trading in their portfolios can face additional challenges due to the nature of futures market data.

Trade matching demands a common language

For example, for trade matching to be successful, data coming from multiple systems must be made to speak the same language. Oftentimes, internal systems have unique ways of expressing product names or other key pieces of information. While equities have a simple trade price, an ISIN, and a uniform ticker symbol, other asset classes don’t. Some systems are built around a particular vendor’s (typically Bloomberg) referential, but futures products don’t have Bloomberg codes or a standardized format.

Artificial intelligence helps software learn and apply rules for standardization

Software used for analyzing futures data must be flexible and intuitively designed, but most importantly needs to leverage the power of artificial intelligence. Without such capability, the efforts necessary to standardize the data for analysis can be Herculean and require a significantly expanded support footprint.

The key to standardizing futures data is a system’s ability to recognize patterns. A system powered by artificial intelligence can learn to recognize uploaded file types, like position files, and classify files as such. When it comes to futures and assets such as cleared swap products, there are no universal ticker symbols. The system must learn to recognize the data type and assign its own referential. Theorem’s software solution deals with cross-asset classes by gathering as many cross-references as possible from the universe of brokers and data sources. The system amalgamates the data and uses artificial intelligence to recognize and classify the disparate elements.

Pricing information should be standardized too

Pricing information also needs to be standardized. Take commodities futures, for example, which are based on an underlying product like corn or pork bellies. One broker may quote a price in dollars, while you may book prices in cents. AI-powered standardization makes it possible for you to do this.

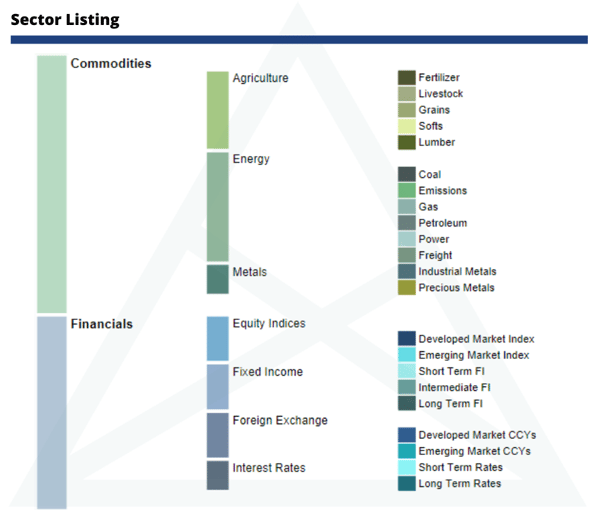

There is no broad-based categorization in futures data, and the only way to distinguish between a contract on an underlying fixed-income instrument and one on a commodity, for example, is to impose your standard. This standardization is necessary to generate understandable and useful reports, such as a hierarchy of trades, to keep firms, fund administrators, and providers all on the same page. For example, the following showcases a categorization structure we have created to establish consistency.

Until the industry catches up, software solutions can solve the standardization problem

There are ongoing initiatives throughout the financial services industry and among the regulators to create standards for financial data. Despite the necessity for standardization, this is a slow-moving process that will take time. Fortunately, there are AI-powered SaaS solutions that can help standardize all types of data, including that from the futures markets, and enhance your firm’s analytical capabilities.

___

About the Author

Rebecca Baldridge, CFA, is an investment professional and financial writer with more than 20 years of experience in creating content and research for asset managers, investment banks, brokers and other financial services clients. She’s worked for some of the biggest names in the industry, including Merrill Lynch Asset Management, JP Morgan Asset Management, BNY Mellon and Franklin Templeton. Rebecca also spent 9 years as an analyst and director of equity research in Moscow, working for several Russian banks. In late 2019, she founded Quartet Communications, a boutique communications firm serving financial services clients. Her writing has been published in outlets including Pensions & Investments, MSNBC.com, Inc. magazine, and Investopedia.com. She holds a B.A. in Russian from Purdue University and an M.S. in Finance from the Krannert Graduate School of Management at Purdue.