Workflow Solution

Streamlined Workflow Management

Seamless Post-Execution Allocation

Capture transactional data and split transitions using our intuitive interface or apply predetermined logic and let Theorem's allocation engine handle instruction creation and transmission to your executing partners.

Run Matches to Proactively Resolve Breaks

Using your allocation instruction or other input data from your transactional system, reconcile against clearing counterparty records intraday using Theorem's flexible matching solution. Identify and troubleshoot trade breaks on T, ensuring you'll get accurate margin calls and reporting while minimizing positional risk.

Over

8 Billion

Records Matched

Connected to

70%

of FCM Seg Funds

Over

180,000

Symbols in 14 Asset Classes

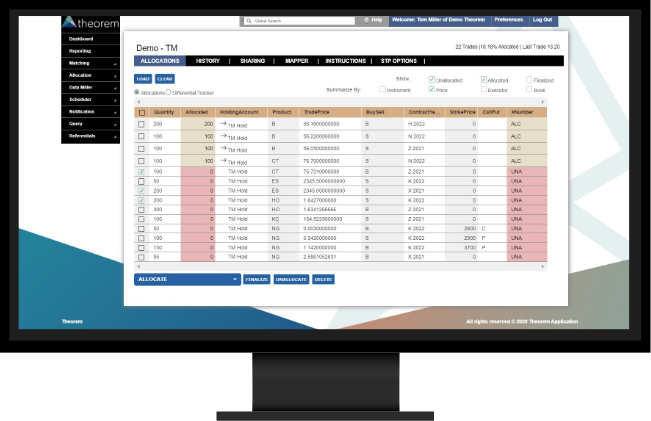

Allocation Solution

Theorem's Allocation solution enables users to manually load or configure an STP workflow from drop copies to load transactional data.

After arranging the data in Theorem's database, users have the flexibility to split transactions using an intuitive online interface or by applying personalized rules. Choose to allocate at the average price, leverage Theorem's best-fit algorithm with dynamic balancing, or even opt for a combination of methodologies based on the clearing venue.

Theorem is connected to the majority of executing brokers, who diligently consume our instruction formats in an STP manner and process internal movements or give up trades to clearing counterparties.

Trade Matching Solution

Theorem's Trade Matching Solution enables users to easily identify any breaks, evaluate their potential impact, and take proactive measures to resolve them before end of trading day.

Through our innovative tools, allocation instructions or other client input data are reconciled with clearing counterparty intraday records. The results are then presented in a user-friendly dashboard or a customizable summary report.

Our no-code onboarding process allows for the seamless addition of new clients, brokers, or accounts. This can be done through simple configurations, eliminating the need for complex development releases.

In addition to intraday matching, leverage Theorem's Matching Solutions to effectively reconcile T+1 positional data, Open Trade Equity, and Excess / Deficit figures, ensuring that your firm aligns seamlessly with its counterparties.

Not trading frequently enough to warrant drop copy automation? Not a problem. Theorem's solution allows for flexibility in loading transactional data into Allocation screens.

Instruct at an Average Price, use Theorem's best-fit algorithm, or a mixture of both methodologies based on your firm's needs.

No more allocation instructions in the body of an email; Theorem's instruction output is securely transmitted and processed systematically, dramatically reducing the risk of a misallocation and a headache on T+1.

Want to utilize predetermined splits to automate the allocation process but are concerned about where odd lots end up? Not a problem, Theorem's Allocation Solution provides the flexibility for users to review applied logic before transmission, giving users the final say.

Run reconciliations based on your needs - whether at the end of the day, several times throughout the day, or continuously. Theorem's Matching Solutions are flexible and fit your firm's behavior.

Match results are accessible through Theorem's online interface and allow users to customize views in the way that makes the most sense to them. For Executives, Theorem will send notices when a match falls below a certain threshold - keeping senior stakeholders in the loop when they need to be.

Subscribe Now!

Sign Up for Our Newsletter

Sign Up HereConnect with a Theorem Specialist

Learn How Theorem Simplifies Top-Day Reconciliation for Hedge Funds and CTAs.